- Company founders and family shareholders firmly established as sellers – fewer transactions among financial investors

- Healthcare and IT sectors account for almost half of transactions – Industrials barely featured in the exceptional year 2020

- Torsten Grede Spokesman of DBAG’s Board of Management: “Buyout market will maintain the momentum shown to date”

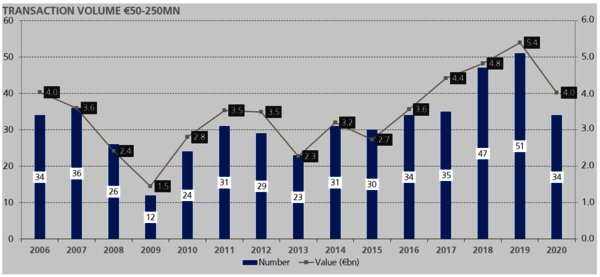

Frankfurt/Main, 28 January 2021. After five years of continuous growth, the buyout market is taking a breather: in 2020, financial investors structured 34 management buyouts (MBOs) involving German mid-sized companies, one-third fewer than the year before. “This has been clearly a consequence of the pandemic: the M&A market came to a virtual standstill in the spring of 2020”, said Torsten Grede, Spokesman of the Board of Management of Deutsche Beteiligungs AG (“DBAG”), commenting on current market data. “What is remarkable is that the market has regained its old momentum since the summer. We expect this trend to remain intact in 2021, for those businesses which have not been hit by the pandemic.” Other developments also continued in 2020: in contrast to the pattern observed since the emergence of the MBO market, over the past five years MBOs have mostly been driven through sales by company founders and family shareholders. “This proves just how attractive Germany is for the private equity sector”, Mr Grede said. Spin-offs from group portfolios are accounting for only a minor part of MBOs in the market segment that DBAG covers. The sector breakdown of Mittelstand MBOs has continued to shift towards the healthcare and software/IT services sectors: basically, investments related to the industrial sector have barely featured in the exceptional year 2020.

With 34 transactions, financial investors in German mid-sized companies structured 17 MBOs less in 2020 than the year before – whilst this was in line with the ten-year average, it was clearly above 2009 – the year shaped by the financial crisis – when only 12 MBOs took place. Founders or family owners sold to financial investors in 18 out of the 34 transactions. This often also involved handing over company management to successors. Five buyouts involved groups spinning off non-core activities by selling them to a financial investor; the remaining eleven MBOs were agreed upon between financial investors.

The analysis exclusively covered transactions where financial investors acquired a majority stake alongside the management team, and which had a transaction value of between 50 and 250 million euros for the debt-free company. This information was compiled from publicly available sources, together with estimates and research by DBAG in cooperation with the German industry magazine FINANCE.

Private equity firms financed buyouts of German mid-market companies with an aggregate volume of approximately 4.0 billion euros in 2020 – 1.4 billion euros less than in the previous year, yet still above the annual average for the past decade. The average company value increased slightly, to 118 million euros (2019: 106 million euros). Almost half of transactions (16 out of 34) were attributable to the lower end of the segment (company value between 50 and 100 million euros), which had accounted for a higher share in the year before.

Continued intense competition in an attractive market

Transactions in 2020 were spread amongst an even higher number of financial investors than in the past: “Competition remains very intense – which also goes to show just how attractive MBOs in the German Mittelstand are", DBAG’s Grede appraises the granular distribution. 25 private equity firms were involved in the 34 transactions observed last year. Around 56 per cent of the transactions (19 out of 34; 2019: 31 out of 51, approximately 60 per cent) were structured by multinational, pan-European private equity funds.

Deutsche Beteiligungs AG accounted for two MBOs in the buyout list for 2020 (previous year: one out of 51 MBOs). DBAG structured two further MBOs in 2020, which were not reflected in the analysis: in one case, the transaction value was below 50 million euros, while another MBO involved an Italian company. Over the past ten years, DBAG has achieved the highest share in this fragmented market (25 out of 345 MBOs, equivalent to 7 per cent). The next position in the market segment analysed is held by two competitors having structured 17 transactions each; furthermore, only five PE houses besides DBAG are shown to have closed more than ten transactions since 2011.

Healthcare and IT services/software are the dominant sectors

The sector structure of the buyout market has changed dramatically over recent years: Companies from the healthcare and IT services/software sectors accounted for 15 of the 34 transactions – almost 45 per cent (2019: 30 per cent). This proportion is in line with the preferences of most private equity investors; DBAG also counts healthcare and software/IT services amongst its preferred sectors. “IT services and software in particular are highly prized since they benefit from the trend towards automation and digitalisation – on which the market focused particular attention during the past year”, explained Mr Grede. “Yet manufacturing industry will retain its role as the heart of Germany's Mittelstand – and will thus remain attractive for private equity investors”, DBAG’s Grede said. “Even though their share in the buyout market has been declining, the number of transactions remains stable – save in this exceptional year 2020 when business models related to manufacturing industry in particular were hard to assess.”

The complete list of the 34 transactions is available here.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads