- Management buyouts in the mid-market sector reach a new record level in 2018

- Industry survey: Family offices are increasingly being seen as competitors by private equity firms

- Torsten Grede, Spokesman of the DBAG Board of Management: “Pricing will be more difficult in 2019”

Frankfurt am Main, Germany, 29 January 2019. Could this be the long-awaited succession wave that is providing a further boost to the private equity business? Last year, company founders and families made up around 40 percent of those selling companies to financial investors – thus reaching, as a result, the largest share ever recorded and a new record level. 19 out of 47 management buyouts (MBOs) in the mid-range segment of the German buyout market were succession agreements in 2018. This represents a further increase compared to the two previous years, which already saw an above-average level of buyouts of companies originating from family ownership. In prior years, barely more than one in ten transactions involved a family-run business. “Founders and family business owners are increasingly starting to realise what sort of contribution financial investors can make to their companies’ further development”, explained Torsten Grede, Spokesman of the DBAG Board of Management, speaking to journalists in Frankfurt am Main on Monday evening. He continued, “we are now seeing increasing numbers of entrepreneurs with new business models in future-oriented sectors looking for new investors – which expands the market for us.”

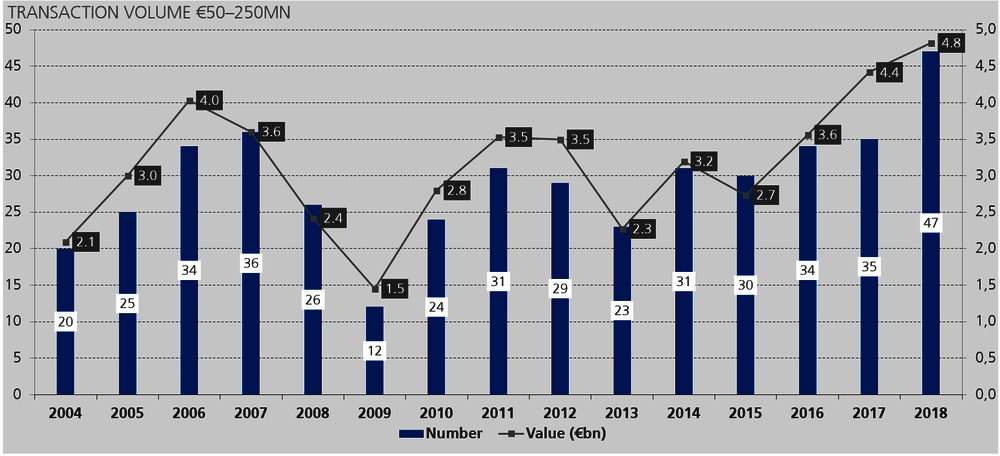

Overall, there was also a significant increase in buyout activity. With 47 transactions, financial investors structured 12 more MBOs in the German mid-market sector than in 2017. This is another new peak figure for this market segment since Deutsche Beteiligungs AG (DBAG) started analysing the market in 2002. In almost half of these transactions (21 out of 47), financial investors were active on both sides, both as sellers and buyers. Corporate demergers or demergers involving conglomerates were once again the exception in 2018, accounting for seven cases.

The analysis only includes transactions in which financial investors have acquired a majority stake in the company in conjunction with the management and that exhibit a transaction value of between 50 and 250 million euros in respect of a debt-free company. It is based on publicly accessible sources, as well as estimates and research compiled by DBAG in collaboration with FINANCE.

Last year, private equity firms financed buyouts in the German mid-market segment worth a good 4.8 billion euros. This is the highest value seen since 2002; in 2017, the market volume came to 4.4 billion euros. The average company value, however, dropped from 126 million euros to 103 million euros. Unlike in 2017, the vast majority of transactions (30 out of 47) in 2018 related to the lower portion of the segment (company values of 50 million euros to 100 million euros). This is in line with the large proportion of company founders among the sellers: out of the 19 MBOs that saw financial investors replace families as shareholders, 13 disposals were made by the company’s founder. As in the previous year, around half of the transactions (24 out of 47) were structured by multinational, pan-European private equity funds.

Deutsche Beteiligungs AG appears on the list of buyouts in 2018 with three MBOs, once again making it one of the most active private equity investors in the market segment under review. DBAG has been involved in 27 transactions in the past 15 years – more than any other financial investor.

Family offices are increasingly being seen as a real source of competition

Despite the larger market volume, the competition on the mid-market German buyout market is intense. This is also due to an increase in capital supply. In addition to the best known private equity firms focusing on investments in the German mid-market sector, there are other companies bringing investments funds into this segment for the first time. There is also the capital of multinational private equity funds, which also have their aims set on the German market. The capital available will also exceed the investment possibilities in 2019.

Setting aside the vast supply of capital, private equity firms are also facing mounting competition from family offices and industrial holding companies. A survey of investment managers from more than 50 private equity firms operating in Germany shows just how intense this competition is. Every six months, industry magazine FINANCE asks the investment managers surveyed about trends in the German SME segment on behalf of DBAG. 72 percent of them said that – leaving strategic buyers out of the equation – family offices had recently been the biggest source of competition outside of the private equity camp. A year ago, only 59 percent of them agreed with the same statement. More than 80 percent of those surveyed agreed that family offices and industrial holding companies had made life difficult for private equity investors in the contest to secure mid-market takeover targets in the last 12 to 24 months. The figures suggest that at least those family offices that have adopted highly professional private equity structures have narrowed the gap separating them from traditional private equity firms. Family offices are being seen as competitors not only in bilateral talks with the sellers of mid-market companies, but also, and almost just as much so, in auctions.

According to the survey, competition among providers is now rated at 8.4 on a scale of 1 (very low) to 10 (very high) – this figure has remained virtually unchanged over the last three years.

DBAG made equity investments to the tune of 270 million euros in 2018

In 2018, Deutsche Beteiligungs AG structured eight management buyouts for funds which it advises. Three of them, the MBOs of the mechanical and plant engineering companies Karl Eugen Fischer GmbH and Kraft & Bauer Holding GmbH and that of the automotive supplier Sero Schröder Elektronik Rohrbach GmbH, are included in the statistics mentioned earlier. The five other MBOs are attributable to different segments of the market. In this respect, DBAG made equity investments totalling approximately 270 million euros. The company has access to two funds for investments in the mid-market segment: DBAG Fund VII – the largest German private equity fund for mid-market investments, with capital commitments of one billion euros – is able to release up to 200 million euros of equity per transaction; a good two years after the start of the investment period, more than 50 percent of the fund has been allocated. DBAG ECF holds majority and minority stakes in companies with low company values. It focuses primarily on owner-led mid-market companies and offers outstanding flexibility thanks to a broad range of investment options with regard to the holding size and holding period, which is especially important for entrepreneurs.

Value appreciation has become more challenging

Despite the recent dynamic development on the buyout market, DBAG does not expect the number of mid-market MBOs to increase any further in 2019. “Macroeconomic distortions, caused for example by Brexit and trading conflicts, elevate uncertainty – which can influence pricing in the M&A business as well as the dynamics of the market”, said Spokesman of the DBAG Board of Management Grede. “As far as the existing portfolio is concerned, the challenge associated with selecting and implementing value creation strategies – for example by expanding product ranges or tapping into new geographical markets – remains a considerable one.”

Please find more information and the complete results of the market survey and statistical analysis, including the full list of MBOs in the German mid-market segment, here (available in German only).

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads