Investors expect commitment

An anonymous survey, conducted among the investment managers of approx. 50 medium-sized private equity companies by the German industry magazine FINANCE and Deutsche Beteiligungs AG (FINANCE Mid-market Private Equity Monitor), reveals that opinions on this topic vary widely.

Even the supposedly easy question as to how important ESG criteria are for limited partners (LPs) when fundraising yields very different answers. On a scale from 1 (unimportant) to 10 (very important), the average answer of surveyed investment managers was 6.7. However, the individual responses varied widely – ranging from 1 to 10. Nevertheless, a median of 7 suggests that most LPs attach great importance to ESG topics.

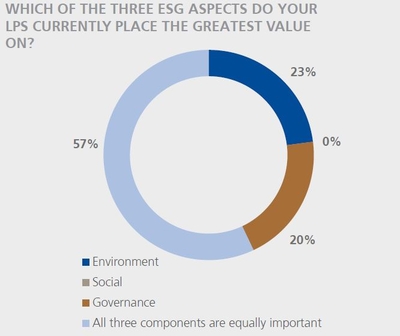

The question as to which ESG aspect is currently rated most important by LPs also failed to yield a clear answer: 23 per cent say: environmental, 20 per cent say: governance, whilst nobody said: social. The majority (that is, 57 per cent) do not see a difference, indicating that their LPs attach the same level of importance to all three ESG criteria.

ESG certificate: private equity has potential for improvement

Increased ESG awareness has long since found its way into the business and corporate finance world. ESG-linked loans are in vogue, as are green bonds and green promissory notes. So, why is there no talk of green unitranches yet? Is the leveraged finance sector immune to the green revolution?

The results of the FINANCE Mid-market Private Equity Monitor at least suggest that the private equity sector has rather neglected ESG topics to date. Whilst nearly half of the private equity companies interviewed now perform a separate ESG due diligence process prior to closing a deal, the main aim seems to be achieving legal security and avoiding negative ESG surprises in the aftermath.

Only very few private equity companies seem to have a real ESG transformation in their portfolio companies on their mind. As such, merely 29 per cent of investment managers said that they addressed ESG topics within the scope of a 100-day plan following the start of an investment.

Furthermore, only 34 per cent of private equity investors stated that they establish ESG performance indicators in their portfolio companies and ask for regular reporting. Last but not least, most private equity investors do not really set ESG incentives for portfolio company management, with only 11 per cent indicating that ESG performance indicators influenced management remuneration. That does not sound like a consistent application of ESG strategies – quite the contrary: every fourth investment manager mentioned that ESG was not integrated into their own processes at all.

“The industry has long been facing the social responsibility”

However, Torsten Grede, Spokesman of the Board of Management of Deutsche Beteiligungs AG (DBAG), notes that the survey results should be taken with a pinch of salt: “As a result of social discussions, ESG aspects are now turning more heads; however, many aspects discussed under this headline have long been a part of responsible corporate action.” He adds: “At least I can say in good conscience that this applies to our Company and our investment process.”

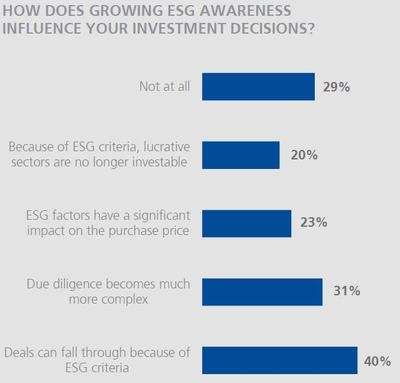

At first glance, the ESG trend is limiting financial investors’ room for manoeuvre: 40 per cent of respondents stated that transactions could fall through due to negative ESG findings, and 31 per cent believe that due diligence processes have become significantly more complex as a result of ESG. Every fifth investor furthermore complains that intrinsically lucrative sectors are no longer investable due to ESG criteria. However, about 30 per cent also think that the increasing ESG awareness does not affect investment decisions at all.

Private equity can exploit ESG opportunities

However, the ESG boom also offers (financial) opportunities to the private equity sector. Certain sectors should find it more challenging or more expensive to obtain new capital in light of the green finance boom. Therefore, private equity investors would be well advised to prioritise ESG strategies, because sooner or later such strategies could have a positive impact on their portfolio companies’ funding opportunities and thus also on investors themselves.

At the end of the day, ESG criteria could help private equity investors turn back to multiple arbitrage strategies on a larger scale. Why is that? Investors who need to allocate significant resources to the company’s ESG transformation when entering the investment will demand an ESG discount on the purchase price. Following a successful transformation, investors can subsequently ask for an ESG premium when selling the investment at the end of the holding period. But even if such an ESG arbitrage – and the desired competitive edge – were not to materialise over the short term, PE investors will generally be forced to ask themselves very soon if they can remain competitive at all without an ESG strategy.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads