Almost 25 per cent of respondents are feeling a lot of pressure

The private equity industry simply hasn't had a chance to catch its breath in months – first, it was rising inflation that provoked turbulence. Then the outbreak of war in Ukraine brought on the next wave of worries. Now, massive supply chain issues for the portfolio companies have been added to the mix, leaving private equity investors struggling for air as evidenced in the latest FINANCE Midmarket Private Equity Monitor.

The industry magazine FINANCE, in conjunction with Deutsche Beteiligungs AG (DBAG), regularly conducts an anonymous survey amongst investment managers at 50 mid-market private equity houses on their current market assessment. The key question this time was what supply chain issues mean for private equity. The survey results are crystal clear: most financial investors, or rather their portfolio companies, are struggling with supply chain issues.

Inflation and rising interest rates impose additional challenges for private equity

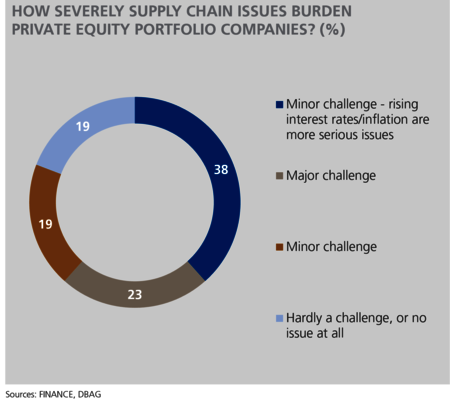

Around 80 per cent of private equity managers surveyed named supply chain issues as a challenge. How big of a challenge, however, is a matter of perspective, with 23 per cent of respondents seeing supply chain issues as a very significant challenge.

38 per cent of respondents felt that supply chain issues were a challenge, albeit a minor one, and that inflation and rising interest rates represented the biggest challenge for private equity at this time. This comes as no surprise, as the current financing environment has a major impact upon the deals a private equity fund can strike – and even might want to strike – as well as in the terms and conditions and the profitability of the transaction.

DBAG agrees that supply chain issues pose a challenge, but a manageable one. Torsten Grede, Spokesman of DBAG’s Board of Management, said: "While supply chain disruptions compromise some of our portfolio companies, these companies only account for around 16 per cent of DBAG's portfolio value as at the end of September 2022."

About 19 per cent of respondents said that supply chain issues only posed a minor challenge, without commenting on inflation and rising interest rates. Another 19 per cent stated that supply chain issues had barely been a challenge, or none at all. It is important to note portfolio compositions in this context. The more industrial companies there are in a financial investor's portfolio, the higher the likelihood of supply chain issues presenting a challenge, whilst private equity investors with a portfolio focused on service providers are less likely to be encountering such issues.

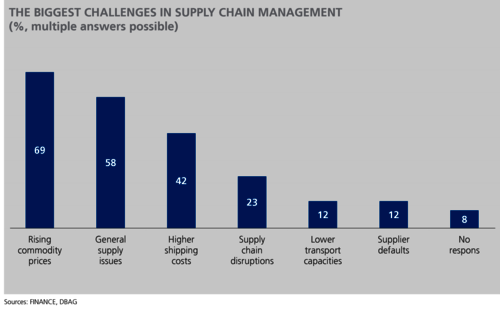

Financial investors and their portfolio companies seem to have differing views on what supply chain issues they are facing. 69 per cent of private equity managers branded rising commodity prices as the biggest challenge (multiple answers possible). More than half the respondents (58 per cent) named general issues such as delays, and almost half of respondents (42 per cent) noted an increase in shipping costs. Around twelve per cent highlighted dwindling transport capacity.

Despite the challenges waiting along the supply chain, the majority of private equity portfolio companies have been able to continue their operations unchanged. Only 23 per cent of respondents reported that portfolio companies had been facing total disruptions of their supply chains, be it in the short or long term. A mere twelve per cent of respondents had to deal with supplier defaults. Eight per cent of those to whom the survey was sent did not respond.

Private equity keeps hiring – but at a slower pace

Whether it's sourcing new transactions or work at portfolio companies – there's plenty to do in private equity. But as salaries rise in response to rising inflation rates, financial investors are reluctant to hire.

While none of the private equity firms surveyed plan any deep cuts in their investment management staff, eight per cent indicated they might slightly reduce their teams. 46 per cent stated that team sizes would remain the same versus June 2022, whilst 38 per cent are looking to slightly strengthen their teams. Back in June 2022, almost half (48 per cent) of respondents wanted to slightly increase the number of investment management staff. Only eight per cent are planning a marked increase, versus six per cent in the previous survey.

DBAG ranks amongst the financial investors that added to their manager numbers: the team grew from 77 to 89 members within one year. DBAG Spokesman Grede explained: "The team registering the biggest addition was our Investment Advisory Team. With 37 investment professionals, it has grown by almost a third since last year."

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads