Target prices significantly above current share price levels

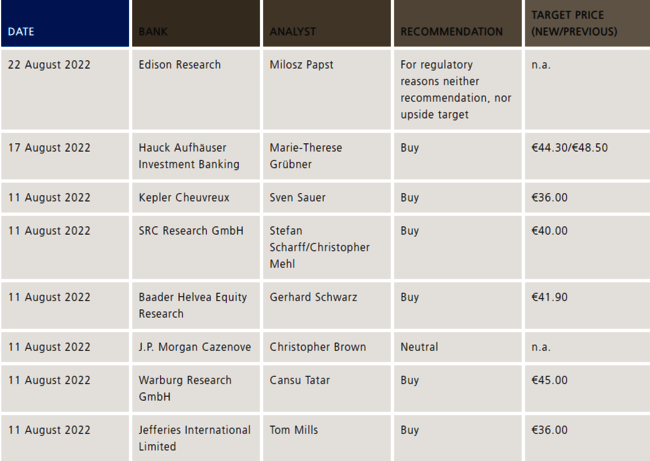

Following publication of DBAG’s results for the third quarter of 2021/2022, all but one of the analysts covering our share have maintained their “buy” rating. Alongside the “neutral” rating from the J.P. Morgan Cazenove analyst, there are six “buy” recommendations still standing. Six analysts have set the target price on a six to twelve months forward basis at between 36.00 euros and 45.00 euros, with the mean at 40.53 euros. Compared to the current share price (Xetra closing price 7 September 2022) of 28.70 euros, this translates to upside potential of approximately twelve euros, or more than 40 per cent. The current target prices already take into account the 2021/2022 forecast we adjusted in July and recently confirmed.

In light of the macroeconomic environment and the sharp decline in valuation multiples, the fact that DBAG generated negative net income after the first nine months of the 2021/22 financial year was described in terms such as “not surprising” (Hauck Aufhäuser Investment Banking). The J.P. Morgan Cazenove analyst highlighted that the seven per cent decline in the net asset value of Private Equity Investments in the third quarter (April to June) was comparable to developments at other listed private equity companies. Analysts based their optimistic take on a slight improvement in market sentiment versus the most recent valuation date of 30 June; they also cited opportunities in the DBAG portfolio. Seven of the 39 portfolio companies are currently still valued at cost, wrote the analyst at Baader Helvea Equity Research, noting that the change in valuation after the first year of the holding period provides a good basis for growth in the net asset value of Private Equity Investments, especially against the backdrop of DBAG's increasing focus on growth companies in the software & IT services sector. Four out of the seven companies still valued at acquisition cost are in this sector.

Research reports are principally addressed to investment professionals and are therefore not available to the public. For legal reasons, only Warburg Research, SRC Research and Edison Research reports are available to download from the DBAG website.

Investor conferences in September – roadshow in October

Deutsche Beteiligungs AG is set to re-intensify its dialogue with investors after the summer break. Torsten Grede, Spokesman of the Board of Management, and Roland Rapelius, Head of Investor Relations, are slated to present information about DBAG at two investor conferences and visit fund managers in Dublin and in London.

The 19th SRC Forum Financials & Real Estate on 13 September 2022 will mark the kick-off, with DBAG attending the conference alongside ten other companies from the financial services and real estate sectors, all of which will give insight into their interim results and the outlook for the remainder of the financial year. SRC founder Stefan Scharff, who managed to organise an in-person event even during the past two years of pandemic restrictions, explained that “conference attendees appreciate the personal exchange.” One-on-ones and roundtable meetings will complement the company presentations.

DBAG’s IR team will leave for Munich following week, to visit the 11th Baader Investment Conference. Spread over five days, roughly 800 investors from 30 countries will come together to learn about German, Austrian and Swiss equity investment opportunities. This year, companies from Spain, the Netherlands and France will be making first-time appearances.

“These two conferences, and the meetings in London and Dublin at the beginning of October, will be important opportunities for us to spread the word directly to investors about our business and long-term outlook,” said Torsten Grede. “Based on our discussions with analysts, we know that – especially in the current setting of interest rate hikes, inflation and broader macroeconomic disruptions – there is a potent need for information.”

The presentation used for investor meetings in Frankfurt and Munich – and later in London and Dublin – will be available for download from the DBAG website.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads