Strong momentum over an entire decade – importance comparable to the German market

Down in Germany, up in Italy – this in a nutshell describes the statistics on private equity market performance in the two countries. And it holds true not only for 2021, but for the first half of 2022 as well.

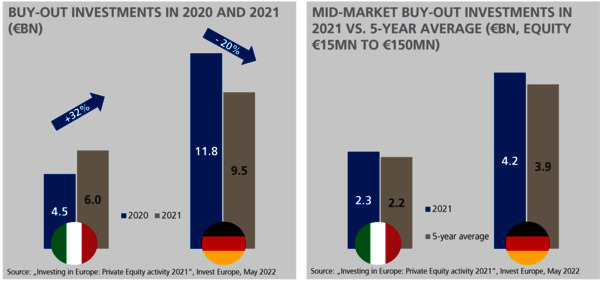

In 2021, the total funds invested by financial investors in buyouts of German companies declined by one fifth compared to 2020. Even the long-term averages (five and ten years) were undercut, despite the whole year being defined by catch-up effects after the pandemic-induced slump. But if we disregard large and very large buyouts (equity investment in excess of 150 million euros or 300 million euros, respectively), segments where DBAG is largely uninvolved, there is an increase of 15 per cent compared to the previous year. Meanwhile, the picture in Italy tells a different story.

There, the volume of buyout investments in 2021 exceeded the previous year by around a third. The number of buyouts also increased and, unlike Germany, the total amounts invested were above the long-term average. Likewise, the Italian mid-market segment, in which Deutsche Beteiligungs AG has invested since 2020 with the DBAG funds it advises, also improved on the previous year. Over the past five years, around 2.2 billion euros were invested annually in small to medium-sized buyouts (equity investment of up to 150 million euros) of Italian companies, putting this segment of the PE market on par with Germany, whose economy is twice the size of Italy's. In Germany, investments in this buyout segment averaged 3.9 billion euros during the period from 2017 to 2021.

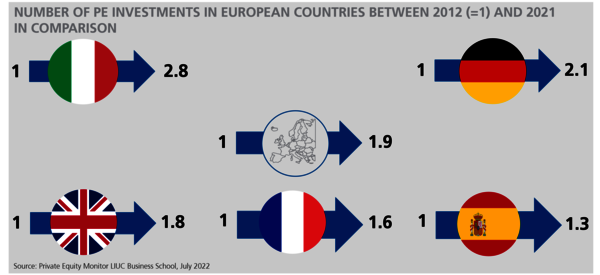

Hence, in 2021, a trend continued that was already observable over the previous decade. Compared to other sizeable PE markets, the Italian private equity market remained particularly robust, as illustrated by an analysis of the Italian LIUC Business School. According to their data, the number of new investments by financial investors in five European countries increased by a total of 90 per cent between 2012 and 2021, with these five countries accounting for around 70 per cent of all PE investments in Europe. Great Britain, France and Spain saw less than 1.9 times the number of investments, exceeding the 2012 figure by only 1.8x (Great Britain), 1.6x (France) or even just 1.3x (Spain) in 2021. At 2.1x, Germany exceeded the European average. But Italy, where the number of PE investments exceeded the level seen in 2012 by 2.8 times, came in with by far the strongest growth.

Pessimism in Germany – continuity in Italy

It seems that the recent divergent trend will continue in 2022, as observer forecasts could hardly be more contrary: “Private equity business climate continues to cool – investors significantly more pessimistic” reads the headline of the German Private Equity Barometer for the second quarter of 2022, which was published at the end of August. Compare this to “Ten percent rise in transactions in Italy”, the headline of a report in the Italian business paper Milano Finanza at the end of July on market activity in the first half of the year.

In Germany, the debate about a stoppage of gas deliveries and the possible consequences are proving to be a powerful driver of economic worries. Banks are much more reluctant to commit to acquisition financing. An uncertain outlook and tighter financing – these circumstances are weighing on the sentiment and subsequently also on deal activity within the private equity market. However, even though deal flow quantity in Germany deteriorated significantly in the second quarter, the quality of transaction opportunities has improved somewhat, and entry valuations have become more attractive. At least that is the assessment of the PE managers who are regularly surveyed by the German Private Equity and Venture Capital Association (BVK). On the whole, both indicators – quantity and quality – are roughly at the mid-point of their respective historical highs and lows.

The Italian PE market is currently more robust than the German PE market. The Private Equity Monitor Index (PEM-i) calculated by the Italian LIUC Business School has been tracking private equity activity in Italy since 2003 and recorded a significant uptick in the second quarter of 2022: while it is not yet back to the level of 31 December 2021 – which marked its most recent record high of 975 points – the index nonetheless reached its third highest level of the last four years, at 800 points.

“Private equity is en vogue in Italy”

A look at the number of buyouts actually concluded shows that momentum on the Italian PE market is clearly holding up. According to the figures published by LIUC, 98 PE investments were made in Italy in the first half of 2022, between 14 and 19 per month, with three-quarters being buyouts. Over the full year 2021, 165 transactions were counted. “The deal flow in Italy continues unabated,” said Giovanni Revoltella in August. Revoltella is a partner and Managing Director of DBAG Italia, and manages DBAG’s business in Italy. One of the recent buyouts was attributable to DBAG: together with DBAG-advised DBAG Fund VIII, DBAG invested in MTWH, a company that produces metal accessories for the luxury goods sector. “Private equity is currently en vogue in Italy,” said Revoltella, pointing to the clear signs. “There have been improvements in the regulatory environment, and – in addition to buyouts – minority investments are increasingly gaining in prominence. Buyouts, which were a rare event in the Italian M&A landscape just a few years ago, now account for more than a third of PE transactions.”

A look at the current macroeconomic data shows another tiny advantage for Italy: the economy there is growing – GDP rose by one per cent in the second quarter, while Germany had to settle for 0.1 per cent growth. But Revoltella guards against overstating the importance of this: “We are in a long-term business, and we are convinced that Italy offers many opportunities for successful investment.”

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads