- Market has been posting double-digit growth rates for years

- “Dominance of transactions in the software, IT and healthcare sectors will be temporary”

- Half of transactions structured by multinational PE funds

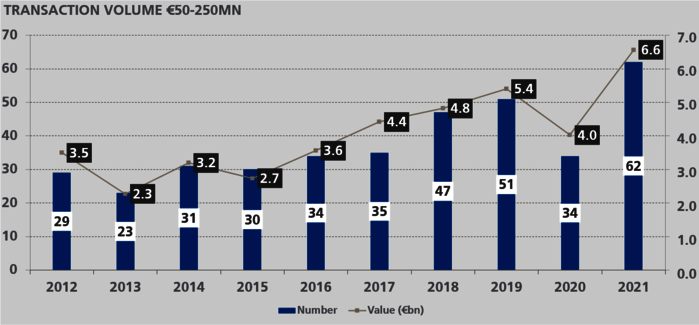

Frankfurt/Main, 26 January 2022. The rapid growth trajectory of the past years continues – in 2021, financial investors structured 62 management buyouts (MBOs) involving German mid-sized companies, a new record. The bump caused by the pandemic has been overcome, and the previous high of 51 transactions that was registered in 2019 (2020: 34) markedly exceeded. The same holds true for the volume, i.e. the total amount of assets involved in these deals, which posted a 1.2 billion euros climb from the pre-pandemic levels of 2019 to reach 6.6 billion euros (2020: 4.0 billion euros). Over the past five years, the market has grown by around 13 per cent per annum on average. The sector breakdown of Mittelstand MBOs has continued to shift towards the healthcare and software/IT services sectors: investments linked to manufacturing businesses and related service providers have played a lesser role. “IT services and software are in demand as they profit from automation and digitalisation trends, and are less cyclical – as is the healthcare sector”, said Torsten Grede, Spokesman of the Board of Management of Deutsche Beteiligungs AG (DBAG), commenting on the market data. “Their relatively small carbon footprint adds to their attractiveness.”

Financial investors structured 62 transactions in German mid-sized companies in 2021 – 80 per cent more than on average over the previous ten years. In more than half of these cases – 33 out of 62 deals – founders or family owners sold their companies. This often also involved handing over company management to successors. Up to the middle of the last decade, transactions of this kind were more of an exception than the norm. 13 MBOs involved financial investors, pushing the share of secondary buyouts to a record low. The remaining buyouts involved groups spinning off non-core activities by selling them to a financial investor.

“The data shows that private equity is here to stay in the German Mittelstand”, said DBAG Spokesman of the Board Torsten Grede, “and that it has an important role to play in Germany’s economic transformation. For private equity companies, triggering and supporting change processes is in their DNA.”

DBAG contributes to the two dominant market trends. All three of DBAG’s MBOs in the past year have served to settle succession issues in founder- or family-owned businesses; two of the companies involved are software or IT services companies. DBAG has always enjoyed special esteem among the shareholders of family businesses. Over the past ten years, 60 per cent of DBAG’s transactions involved family-owned companies, while only 40 per cent of 376 Mittelstand buyouts fell into this category between 2012 and 2021.

The analysis exclusively covered transactions where financial investors acquired a majority stake in a German company alongside the management team, and which had a transaction value of between 50 and 250 million euros for the debt-free company. This information was compiled from publicly available sources, together with estimates and research by DBAG in cooperation with the German industry magazine FINANCE.

Deutsche Beteiligungs AG has highest market share on a ten-year basis

Competition remains high. During 2021, more than 40 financial investors were involved in the 62 transactions in German mid-market companies. Over half these transactions were structured by German private equity firms (32 out of 62 MBOs). The share of multinational, pan-European private equity funds declined year-on-year (48 per cent after 56 per cent). One private equity company structured five MBOs; DBAG and three other firms structured three transactions each. Over the past ten years, DBAG has achieved the highest share (25 out of 376 MBOs, equivalent to 7 per cent). The next position in the market segment analysed is held by a competitor having structured 19 transactions; three more are listed with 16 MBOs. Besides DBAG, the statistic shows that only six private equity houses have structured more than ten mid-market buyouts since 2012.

Asset-light business models dominate the market

Following the most recent rotation, the sector structure that can be found in the buyout market does not match that of the German Mittelstand, with one-third of buyout transactions during 2021 taking place in information and communications technology, and transactions in the healthcare sector accounting for another 21 per cent of MBOs. “The current sector mix will certainly be temporary, given that industrial business models are currently difficult to assess due to the structural changes in the automotive sector and supply chain shortages”, said DBAG’s Grede, adding: “We continue to see good opportunities for successful investments in technology companies in the industrial sector – in particular if their products help other companies in making their processes faster, simpler and more effective. Overall, private equity has a major role to play in the transformation of manufacturing as production industries decarbonise.”

The list of the 62 transactions is available here.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads