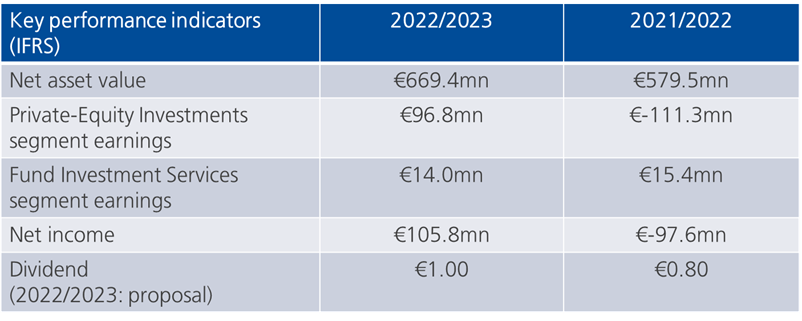

- Net income of around 106 million euros confirmed

- Net asset value (adjusted for dividends) rose by more than 18 per cent

- Earnings from Fund Investment Services at 14 million euros, as expected

- Positive outlook: targeting double-digit growth of the net asset value in the current financial year

- Updated distribution policy: Total distribution of 18.8 million euros translates into a dividend yield of 3.5 per cent

Frankfurt/Main, 30 November 2023. Deutsche Beteiligungs AG (“DBAG”) has successfully concluded its financial year 2022/2023. The key performance indicator of net asset value saw double-digit growth of more than 18 per cent, adjusted for dividends. Net income amounted to approximately 106 million euros, as preliminary confirmed on 20 November 2023. These developments are testament to DBAG’s ability to exploit attractive opportunities for its shareholders and the Company, even under challenging market conditions. Based on these results, the Company proposes distributing 18.8 million euros in dividends; this corresponds to one euro per share and a dividend yield of 3.5 per cent.

Successful transaction activity

During its financial year 2022/2023 DBAG succeeded in entering five new investments. With Avrio Energie, a leading operator of biomethane plants, and TBD, a provider of technical construction services for infrastructure solutions, two of DBAG’s new portfolio companies are active in the area of energy supply. The Company further expanded its portfolio in the IT services and software sector through its investment in AOE Group, a service provider for agile software development – DBAG’s seventh investment in an industry enjoying structural growth.

DBAG was also active in terms of disposals, realising a total of six, including two partial disposals, during the financial year 2022/2023. These include Pmflex, the Company’s first investment in Italy, and Cloudflight, in which DBAG has retained a minority stake given its promising development.

DBAG’s exposure to Italy is also continuing to grow, with portfolio company MTWH having acquired Metalstudio Group. This acquisition will strengthen the company’s strategic positioning as a centre of excellence for accessories in the luxury market and will double its revenues – another transaction that pays testimony to DBAG’s expertise in the Italian market.

DBAG provides a positive outlook, despite the persistent macroeconomic challenges

The geopolitical challenges, continued inflation and the resulting postponement of consumption, is impacting all areas of social and business life. DBAG has succeeded in utilizing attractive opportunities despite the challenging market situation. The successful financial year 2022/2023 highlights the attractive prospects that the private equity market has to offer, even in challenging times. DBAG’s outstanding access to family-owned businesses, combined with its broad network of industry experts, leads often to bilateral negotiations. This provides DBAG with a decisive advantage in terms of negotiations and exploring opportunities for value enhancement – to the benefit of all of DBAG's stakeholders.

Accordingly, the Company forecasts net asset value for the current financial year in a range between 675 and 790 million euros, taking the proposed dividend into account. On average, this represents double-digit growth. Adjusted for the proposed distribution, this equates to an increase in value of between four and 21 per cent. DBAG expects this key performance indicator to further rise over the medium term, meaning that by the end of the 2025/2026 financial year, net asset value is projected to amount to between 840 and 980 million euros. Taking anticipated dividend distribution into account, these projections point towards an average annual increase in net asset value of between 10 and 16 per cent.

Earnings from Fund Investment Services are likely to drop vis-à-vis the previous financial year 2022/2023, in line with the life cycle of the funds and in view of cost developments. Against this background, DBAG anticipates a range between 9 and 13 million euros for its current financial year, rising to between 11 and 16 million euros for the financial year 2025/2026.

DBAG believes that the performance of its portfolio companies continues to develop favourably, thanks to the planned implementation of value appreciation strategies and despite a macroeconomic environment that is likely to remain challenging.

Updated distribution policy: dividend proposal of one 1.00 per share

DBAG has updated its distribution policy in November 2023, setting the objective to have shareholders participate in the financial gains of a given financial year in the form of stable dividends amounting to at least 1.00 euro per share entitled to dividends. In addition, there are plans to consider share repurchases on a more regular basis, as a flexible option enabling shareholders to achieve additional participation in the Company's positive development. The purpose is to reflect the long-term orientation of DBAG's business model in its dividend policy.

Please find further information in our Annual Report 2022/2023.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads