Analysts take a positive stance on DBAG shares

DBAG’s financial statements for the 2019/2020 financial year were once again viewed in a positive light by most analysts: they emphasised that both the net asset value of Private Equity Investments and the earnings from Fund Investment Services reached the upper end of the forecast range, or even slightly exceeded it. Tim Dawson, who covers the DBAG share and provides research to asset managers, also commented on the growth rates announced by DBAG for the current financial year and the two subsequent years (planning period 2020/2021 to 2022/2023), stating that forecasts are “realistic”. Christopher Brown, one of the sector's most experienced analysts, sees these figures as “encouraging evidence of strong returns” (30 November 2020); Brown tracks more than a dozen listed private equity companies for JP Morgan Cazenove.

“Are the targets realistic?”

Results for 2020 are far less important than what management has to say on future developments, according to Baader analyst Dawson in his latest review of DBAG shares (30 November 2020). Dawson believes that investors should be asking themselves two questions: “Are the targets realistic and achievable?” and “Are there any financing problems or constraints that could prevent achievement of, or dilute the longer-term targets?”

Similar to Marie-Thérèse Grübner of Hauck & Aufhäuser (HA, 2 December 2020), Dawson does not see any major risks to targets for the Fund Investment Services segment. Fee arrangements – i.e. the conditions under which the DBAG funds are paid for by investors for services provided by the DBAG investment team – are part of a fixed contract, which prevents a squeeze on margins in this context, Dawson writes. In addition, net income generated by Fund Investment Services is expected to almost completely provide the funds required for the dividend, which is therefore also secure.

But what is analysts’ perception of target net asset value growth in the Private Equity Investments segment – projected at as much as 14 to 19 per cent on average for the next three years? In common with HA analyst Grübner, Tim Dawson highlights two elements: firstly, those portfolio companies with an industrial focus – 19 out of 32 at the most recent reporting date – are currently valued at less than their original acquisition cost. Provided that a broader economic recovery emerges next year, sales and earnings for these companies will get a boost, triggering positive changes in value. According to HA’s latest report on DBAG shares (4 December 2020), “the rotation of the market towards cyclical investors will support valuations”.

DBAG’s long-term track record being noted

Dawson points to the nine investments in growth sectors, such as broadband telecommunications or IT services/software, as the second element securing growth in net asset value. If only the youngest of these investments (holding period up to two years) performed as well as the more mature ones, this alone would result in an increase in value of around 75 million euros. And finally: Dawson writes that even the upper end of the range for the net asset value in three years (660 million euros) is only 1.7 times the acquisition cost of the current portfolio and highlights DBAG’s successful track record in terms of investment performance: MBOs have achieved an average exit multiple of 2.7 times the cost of acquisition over the past 20 years – growth financing achieved a multiple of 3.4 times during that period.

The final issue to be considered is the availability of financing for investment projects – which average 120 million euros over the next three years: the Baader analyst believes that DBAG should be in a position to finance the current year’s investment projects in view of available financial resources of around 95 million euros. Disposals are also likely to bring in the bulk of the necessary funds. However, Dawson also refers to DBAG’s recently renewed statement that even after agreeing a new, additional credit line, further options for debt and equity financing would be considered.

In referring to DBAG as a “high quality investment in the private equity segment”, this experienced analyst shares the same opinion as Marie-Thérèse Grübner (HA): only a few weeks ago, she declared DBAG a “blue-chip listed private equity stock, with strong prospects”.

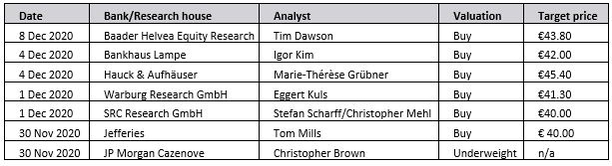

Research reports are generally aimed at professional investors and are therefore not available to the public. Legal restrictions mean that only Warburg Research and Edison Research reports are available to download from the DBAG website. It shows a regularly updated table of analyst recommendations and price targets.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads