New structure in the acquisition finance market – private debt continues expanding its market share

The process of radical change in the acquisition finance market has been ongoing for some time now, with recent external shocks only serving to shift the development up another gear: extensive regulatory changes for banks on the one hand, and substantial inflows into the private debt asset class on the other, are not only triggering significant shifts in market share from banks to debt funds. They have also resulted in the emergence of new structures for, and perspectives on, the financing of corporate acquisitions using private equity. What is more, the corporate sector and their financiers have been presented with unprecedented challenges over the last two years in a list topped by a pandemic, the war in Ukraine, supply chain disruption and reorganisation, material bottlenecks and the return of inflation.

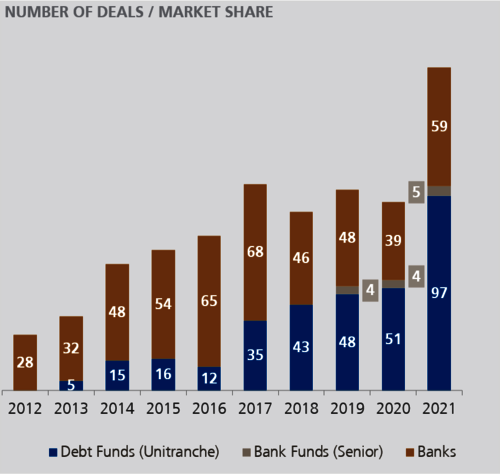

The increase in debt funds’ market share compared to conventional senior bank financing in the German-speaking market speaks for itself: in terms of number of transactions, the market share of unitranche financing has been on a steady upward trajectory since 2016, rising from 16 per cent to 63 per cent in 2021. Even though the biggest surge in favour of debt funds was witnessed back 2018 (48 per cent market share), they have continued to cement their dominant position over the past three years.

Source: Houlihan Lokey

So what are the factors driving these massive shifts in market share? First, the basis for pricing credit risks has changed: in particular, the “Basel IV” regulations, which were adopted at the end of 2017 and are gradually entering into force, are having a negative impact on the granting of “non-investment grade” rated acquisition financings by banks, which now have to hold more capital for these. This comes at the expense of returns, or translates into higher prices, i.e. lending rates. This puts bank financing at a competitive disadvantage compared to debt funds, which are not regulated in this respect. The latter are accountable only to their investors, meaning that they can price a much broader range of risks. In addition, smaller banks, which have to base their capital backing simpler approach under Basel IV compared to their larger competitors, are increasingly withdrawing from the market.

Second, there have been substantial fund inflows into private debt as an asset class in recent years. Central banks in all of the world’s major economies have kept interest rates low over the past decade, triggering high levels of liquidity in conventional asset classes. In order to meet their investors’ return expectations, major institutional investors have increasingly been adding higher credit risks and alternative, less liquid asset classes to their portfolios. This development has increasingly put debt funds in a position to recruit talent from the banking, but also the private equity environment.

Pricing risks, ticket size, implementation – debt funds score advantages over banks

Debt funds now have three key advantages over mid-cap investment companies – they can price a broader spectrum of risks, offer comparatively large tickets and often adopt a more entrepreneurial approach.

Pricing a broad spectrum of risk: Intense competition on the debt funds market has led to a differentiated product offering. Some of the larger funds, like Alcentra, Arcmont or Barings, now have several pots of capital that they can use to offer products entailing different levels of risk at the appropriate credit margin (e.g. stretched senior, unitranche, subordinated financing). Some funds can go even deeper into the capital structure and co-invest equity.

Ticket size: The funds operating in the relevant market segment can handle financing volumes of between 40 and 450 million euros under their own. Typical bank tickets, on the other hand, sit in a range of only between 15 and 30 million euros. This means that, in practice, larger financing arrangements require several banks to join forces to create a “club”. This increases the complexity involved due to the need to negotiate and consult with multiple parties, and also due to the potential for diverging interests over time as well as the increased work associated with coordination. This is particularly relevant for buy-and-build stories, i.e. the active market consolidation that follows the acquisition of a platform company through a series of add-on acquisitions. In the mid-cap private equity segment, i.e. comprising MBOs with an enterprise value of between 50 and 300 million euros, buy-and-build is a key strategy. From an owner’s perspective, buy-and-build situations call for financing partners that can act quickly and adopt an entrepreneurial mindset, in addition to being flexible in terms of the sums involved. Debt funds are in a position to deliver just that. There are several cases in which, within the space of only two to three years, a single debt fund has accompanied a PE investor in the implementation of a buy-and-build strategy from the lower to the upper end of the financing volume that is feasible for it.

Entrepreneurial mindset and firm focus on implementation: Once the financial cornerstones of a financing arrangement have been agreed, many debt funds are relatively pragmatic in their approach to implementation. In combination with streamlined, flexible and, as a result, swift decision-making processes, the financing process can be accelerated significantly compared to the club deals that are typical with banks in the mid-cap market. This can offer a decisive advantage, not only in highly competitive bidding processes. And that’s not all: this is often the only way to meet the seller’s deadlines and make the transaction possible in the first place. In a buy-and-build context, too, an entrepreneurial approach (as opposed to the predominant focus on risk that tends to be more prevalent on the banking side) is crucial to successful implementation.

How banks are reacting: overall reduced activity and new ways to cooperate

Changes in regulation and the competitive landscape have prompted a number of banks to leave the private equity acquisition finance business altogether. Examples of late include IKB, nibc and most recently BayernLB. Other banks, such as DZ Bank and Commerzbank, are adopting a relatively selective approach.

Quite a few banks that are still active have given up their initial resistance to cooperating with debt funds: the majority now provide what is known as super senior financing, i.e. credit tranches that enjoy priority ranking relative to those provided by debt funds. In addition to the working capital facilities required for the operating business of the borrowing companies, these now often also include super senior term loans. Super senior loans match banks’ risk appetite and can be offered by them in a manner that allows them to make a profit; banks also earn money from the operational banking business and maintain a long-term relationship with the company. While the debt fund assumes a riskier position in the capital structure, it can still realise its target return. From the equity investor’s point of view, the weighted average cost of debt is reduced, despite the slightly higher unitranche margin. Finally, unitranche loans remain competitive with the “stretched senior” option now also offered by debt funds from the equity investor’s perspective.

A number of banks cooperate exclusively with senior debt funds or have launched senior debt funds of their own so that they can join forces to offer larger tickets (typically up to 50 or 60 million euros, for example Credit Suisse, DZ Bank and OLB). They assume responsibility for sourcing the deals for the funds. Larger banks, and those with international operations, sometimes find ways to insure or outplace parts of their credit exposure under the radar so that they can provide financing of up to 100 million euros under their own steam. Other banks offer the unitranche product through a debt fund they launch themselves (e.g. Deutsche Bank).

Ultimately by far the most successful market entry witnessed in recent years has been achieved by a bank specialising in a single sector: apoBank finances company acquisitions exclusively in the healthcare market. In line with this focus, it boasts an excellent understanding of business models in this sector, which allows it to offer very efficient cooperation compared to many of its competitors.

LBBW has expanded its market share in bank financings pursuing a very traditional approach over the past two years: it continues to offer only “conventional” senior bank financing with a broad-based team. LBBW covers the entire German market, has been able to gain market share from banks that opted to withdraw from the market and conveys an image of an experienced and predictable financing partner.

Finally, senior banks are increasingly receiving support from independent senior debt funds such as Allianz, Arcos or AkquiVest, which can either complement bank syndicates or provide much greater flexibility in senior syndicates in terms of the amounts involved, allowing buy-and-build strategies to be implemented on the back of bank financing as well.

Larger financing offering for private equity funds

From an equity investor’s perspective, these market changes are serving primarily to create attractive options for financing a broader range of potential acquisition targets. The significantly increased market scope and the increasingly focused approach taken by individual lenders at the same time also, however, means that much more expertise and work are required to achieve optimum financing results. Depending on the transaction frequency, strategy and team size, private equity sponsors address these requirements by specific internal resources and/or external financing advisors.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads