Editorial

Social, geopolitical and economic tensions have been on the rise across the globe for some years now. Now, it would appear, we have to brace for a lasting crisis on multiple fronts that calls our hitherto orderly world and economic order into question. This development is resulting in fundamental changes to the demands placed on the corporate sector.

More than ever, companies have to be able to pick up on changes quickly and be willing to adapt to them. DBAG has been proving its adaptability for almost 60 years now – that’s how far back our roots go. There are only a handful of companies in our industry with such a solid foundation and this is precisely what sets us apart.

This decades-long successful track record would not have been possible if we had not also been willing and able to make fundamental changes. We would like to thank all of our employees, who – through their strong commitment – have contributed so much to the Company's further development. The overarching objective that guides us unwaveringly is to closely align the interests of all parties involved: the interests of a company and its shareholders, the interests of the members of our Investment Advisory Team and our portfolio companies and, of course, the interests of DBAG, our shareholders and our fund investors. We have put structures in place where possible and firmly established them in order to achieve this sort of alignment, but most importantly, it is also the focal point of our thoughts and actions.

The successful financial year 2022/2023 highlights the attractive prospects that the private equity market has to offer, even in challenging times. Our tradition of excellent access to family businesses allows us to leverage a strong network of experienced names in the business in what are frequently bilateral negotiations. This opens up very special opportunities for us to invest in attractive companies, allowing our shareholders and our fund investors to benefit from value appreciation.

We want you, dear shareholders, to continue participating in DBAG’s financial performance. Our distribution policy, which we have updated in November 2023, aims to have shareholders participate in the financial gains of a given financial year in the form of stable dividends amounting to at least 1.00 euro per share entitled to dividends. In addition, DBAG plans to consider share repurchases on a more regular basis, as a flexible option enabling shareholders to achieve additional participation in the Company's positive development. The purpose is to reflect the long-term orientation of DBAG's business model in its dividend policy. If you accept our dividend proposal, you will be receiving a current yield of 3.5 per cent on your investment in Deutsche Beteiligungs AG, measured against the average share price in 2022/2023, alongside the appreciation gained through the share price development.

Looking ahead to the future, we are aiming to further expand our strong market position and add private debt to the range of solutions we offer. This will see us establish ourselves as a full-service provider for the financing needs of mid-market companies across their entire capital structure. With this goal in mind, we acquired a majority stake in ELF Capital Group in September 2023. ELF Capital advises funds that provide flexible private debt financing for established, market-leading mid-market companies with a geographical focus on the Germany, Austria and Switzerland region, the Benelux countries and Scandinavia. We are convinced that this will allow us to create further potential for value appreciation for our shareholders.

In the financial year 2023/2024, which has only just begun, we are aiming to continue with our successful development and anticipate a further increase in our net asset value. Earnings from Fund Investment Services are likely to drop vis-à-vis the previous financial year 2022/2023, in line with the life cycle of the funds and in view of cost developments. This would make the financial year 2023/2024 another successful year overall from the medium to long-term perspective that is decisive for our business.

The Board of Management

of Deutsche Beteiligungs AG

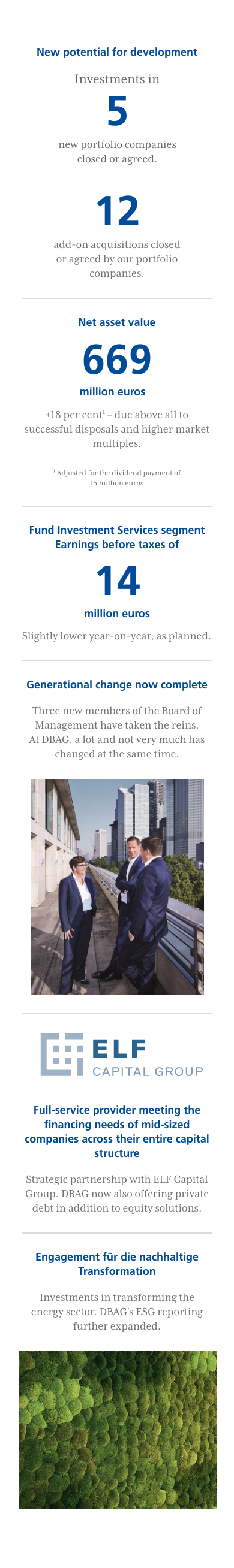

f.l.t.r.: Jannick Hunecke, Member of the Board of Management – Tom Alzin, Spokesman of the Board of Management – Melanie Wiese, Chief Financial Officer

Contents

Brisk investment activity in the DBAG portfolio

Our portfolio continues to go from strength to strength, with many acquisitions and disposals being effected throughout the year. Our reinvestments allow us to participate more and more in areas with untapped potential. And our new investments are extremely promising and help broaden our sector focus.

Interview with the DBAG Board of Management

“Continuity through change”

The DBAG Board of Management talks about growth prospects, value enhancement and strategies to ensure sustainable economic success in times of transformation.

The DBAG Share

An exceptional business model – an exceptional share

DBAG shares allow investors to participate in a unique integrated business model: they are given access to continuous earnings contributions made by the advisory services provided to private equity funds and, at the same time, the opportunity to participate in the performance of a portfolio of top-performing unlisted mid-sized companies.

Stories

Brisk investment activity in the DBAG portfolio

Our portfolio continues to go from strength to strength, with many acquisitions and disposals being effected throughout the year. Our reinvestments allow us to participate more and more in areas with untapped potential. And our new investments are extremely promising and help broaden our sector focus.

Interview with the DBAG Board of Management

“Continuity through change”

The DBAG Board of Management talks about growth prospects, value enhancement and strategies to ensure sustainable economic success in times of transformation.

The DBAG Share

An exceptional business model – an exceptional share

DBAG shares allow investors to participate in a unique integrated business model: they are given access to continuous earnings contributions made by the advisory services provided to private equity funds and, at the same time, the opportunity to participate in the performance of a portfolio of top-performing unlisted mid-sized companies.

Sustainability at DBAG

Sustainable actions are more important than ever. For us, that means striving for a long-term increase in DBAG’s value, while taking ecological, social and corporate governance criteria into account (ESG criteria).

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads